Preparation and Negotiation of Title Commitments

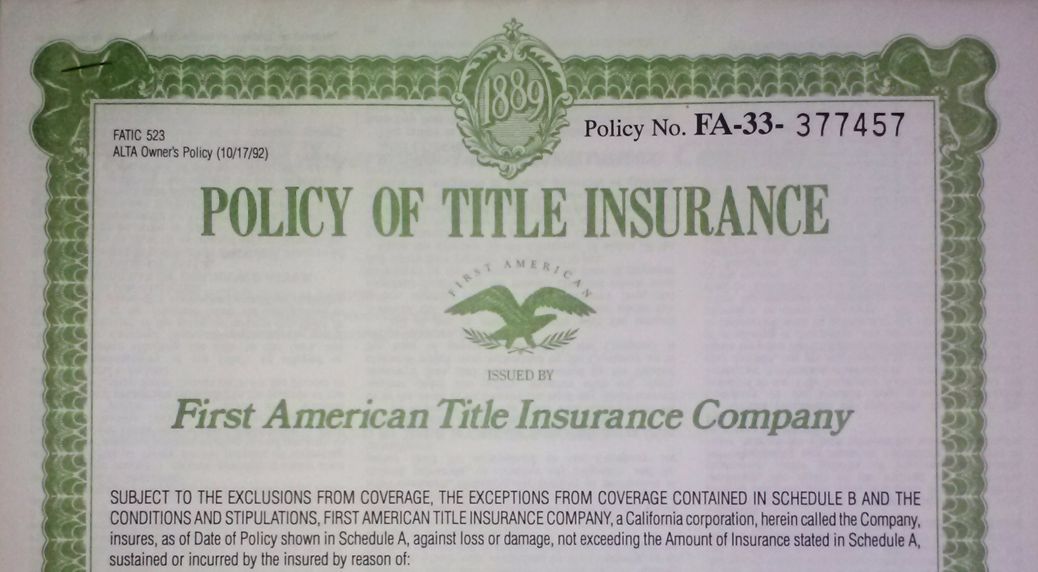

Title Insurance is an important part of every real estate transaction. The insuring of title to real property consists of two distinct steps: 1) the issuance of a preliminary report that describes title conditions, which will serve to limit the title insurance if issued (the “Commitment”); and 2) the final title insurance policy that may have all or some of the limitations to coverage spelled out in the preliminary title report. The Commitment is really a contract to issue title insurance at a future date when the terms of the Commitment are complied with.

The Commitment is an essential document in a real estate transaction. Therefore, mastering the Commitment is an essential part of a successful real estate transaction. Most real estate contracts specifically require one party to pay for and obtain a Commitment and an owner’s policy. In the alternative, the real estate contract may call for the seller to provide the buyer either: (1) evidence that the seller is the titleholder of record; or (2) evidence of the condition of title, along with a specific number of days for the seller to perfect title to the property. The title evidence that is usually requested to meet this requirement in such a real estate contract is a Commitment. In either case, failure to provide a Commitment could result in a default under the terms of the real estate contract.

Schedule B-1 of the Commitment should be your checklist for closing. This Section lists all the requirements that must be satisfied before the policy will be issued. The purpose of the requirements is to assure that title will properly vest, without exception, other than as set forth on Schedule B-2, in the proposed insured. Everything is spelled out clearly in Schedule B-1. All of the documents that you will need and the steps that you have to take to assure clear title are there for you in black in white. You can simply make a copy of B-1 or add it to your over all checklist. But until you have all of the items on B-1, you can’t close.

Schedule B-2 contains the items that will not be covered by the final title policy to be issued. It contains both the standard exceptions and the specific exceptions to title. The specific exceptions are the matters that have been found after examination to affect the property and will not be covered when the policy is finally issued. It is important to always carefully review the commitment and all of the exceptions. Just because the commitment contains a list of exceptions does not mean that they all apply or are actually exceptions. If you are representing a buyer or a lender, it is your job to make sure that title is accurate and beneficial to your client and that none of the proposed exceptions will interfere with your client’s proposed use of the property. If any exception does not actually affect the property, request that the seller and underwriter delete it. If the exception adversely affects the proposed use of the property, you need to figure out how to delete or revise the exception. The art of title is negotiation.

My favorite part of a real estate transaction is negotiating the title commitment. There are at least three people to negotiate a commitment with: the agent, the examiner and the underwriter. If you are the agent, obviously, you aren’t going to negotiate with yourself. Your interest in negotiating the commitment is going to differ depending whether you represent the borrower or the lender. But the seller, who has no insurable interest, often gets involved in negotiating commitments because when the title objection letter comes from the buyer, sometimes the best way for the seller to address an objection is to negotiate with the underwriter to change a requirement or delete an improper exception.

When I receive a new commitment, I review the requirements and exceptions carefully. I review the underlying documents to understand why the examiner included them on the commitment. I analyze what is going to need to be done to satisfy each of the requirements and make sure that the properties and people and entities set forth in the requirements are the same as those involved in my transaction or are properly related to my transaction. If the connection is not obvious, I flag the requirement. As to the exceptions, I read each one and make sure that none would adversely affect the property or the buyer’s intended use, or, if I represent the lender, would violate any term of the loan documents. And, I make sure that the exceptions actually apply to the property and haven’t otherwise expired.

After this review, I often have 2 lists, one is a list which I put in a title objection letter to the seller. But the other is a list which I discuss with my examiner, if I am the agent, or with the agent, if I am not. This list will consist of issues that should be resolved by the title company as opposed to the seller, including satisfaction or deletion of inappropriate requirements and deletion of misplaced exceptions. The caveat here is that the examiner is just a scrivener. So if the issue is one where you can show that a document like a partial release was missed in examination, or a mis-spelled name appears, the issues can be quickly resolved. But anything more complicated requires an underwriter’s attention. As issues are resolved, Schedules B-1 and B-2 are revised and the Commitment updated. And finally, at closing, documents are presented, executed, recorded, and the remaining requirements satisfied so that the final policies may be issued.

The work that goes into insuring title to property prior to closing can be the easiest part of a closing or the most difficult part of a closing. Sometimes one issue can delay a closing for a many weeks. It is important to take these issues seriously and to work with your attorney and underwriter to resolve all issues.

Carlos Reyes

April 23, 2016 1:03 pmDavid – excellent and helpful summary. Most clients don’t realize how these can help or hurt them until its too late. Of course, that’s mostly due to the fact that most of us handle it seamlessly as part of the transaction process. Again, very good summary. Congrats.